WASHINGTON – Space industry startups attracted $5.7 billion in financing in 2019, “shattering the $3.5 billion record set the previous year,” according to a new report by Bryce Space and Technology, a Washington consulting firm.

While Investors took stakes in 135 space startups around the world, four of the largest ventures – SpaceX, Blue Origin, OneWeb and Virgin Galactic — claimed nearly 70% of the total financing, according to “Startup Space: Update on Investment in Commercial Space Ventures” published March 9.

SpaceX and Blue Origin combined collected $1.9 billion in 2019, Bryce estimated. Meanwhile, OneWeb received about $1.25 billion and Virgin Galactic raised more than $682 million, thanks largely to its reverse merger with special-purpose acquisition company Social Capital Hedosophia and subsequent public trading of its stock, according to the report.

Although investors and entrepreneurs continue to predict a slowdown in the sector, “2019 brought no clear evidence of lost momentum,” according to the Bryce report. In fact, the report notes, all 2019 indices were higher than those of 2018. The number of startups raising money climbed 34%. The number of investors rose 46%. The tally of deals completed was 36% higher. And total investment jumped 61%.

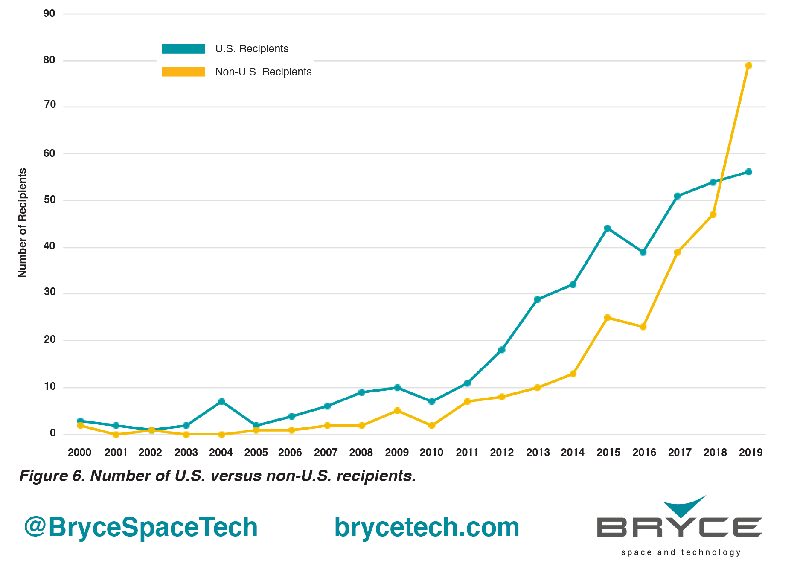

U.S. firms claimed the lion’s share of funding in 2019 but investment activity also was strong in other parts of the world.

“The year saw a surge in the number of non-U.S. startups obtaining financing: 79 in 2019, compared to 47 in 2018,” according to the report. “The number of U.S. firms, meanwhile, appears to be leveling off with 56 in 2019 compared to 53 the year before. This is the first year where the number of non-U.S. companies receiving investment exceeded the number of U.S. companies.”

Many of the firms raising money were in Asia like Singapore-based Kacific’s, which obtained $160 million in debt financing in 2019. Meanwhile, Qianxun Spatial Intelligence, a Chinese firm, claimed $141 million in a Series A investment round for a precision location service that relies on China’s Beidou constellation.

“Non-U.S. seed and venture investment, the number of non-U.S. firms reporting investment and the number of non-U.S. investors” were greater in 2019 than in 2018, according to Bryce.

In spite of investor enthusiasm for the sector, the Bryce report highlights concerns about profits.

A small percentage of the space startups financed in recent years are producing revenue and it’s tough to say whether any of them are profitable, Janice Starzyk, Bryce vice president of commercial space, told SpaceNews.

Another key takeaway from the report is the growing role of government agencies. Government contracts provided many of the large and small companies with contracts. Private investors viewed those contracts as a stamp of approval, according to the report.

In addition to taking a close look at 2019 investment activity, the report discusses cumulative financing since 2000. Over two decades, space startups have received “$27.8 billion, including $12.5 billion in early and late stage venture capital, $4.6 billion in seed financing, $1.8 billion in private equity and $5.1 billion in debt financing,” according to the report. Mergers, acquisitions and public offerings provided another $3.8 billion, the report added.

More than 60% of the startup space investment activity in the last 20 years occurred in the last five years. Space startups raised $2.8 billion in 2015, $3 billion in 2016, $2.6 billion in 2017, $3.5 billion in 2018 and $5.7 billion in 2019, the report said.

Eighty percent of the money startups raised in the last five years came from seed funding and venture capital. When debt financing was excluded from the equation, the report found that more than 70% of investment activity in space startups since 2000 had occurred in the last five years.